The Direct Care insurance analogy

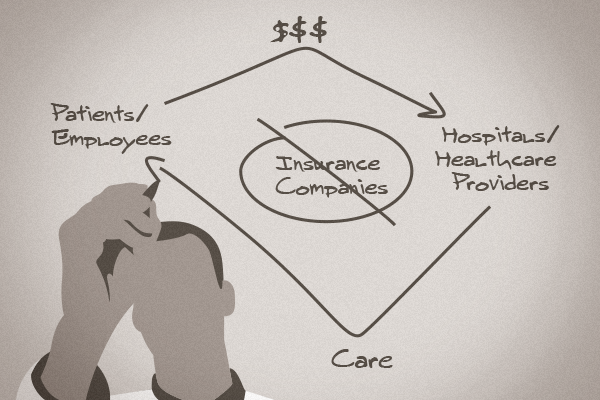

Those involved with Direct Care use an analogy to explain how insurance and Direct Care work together. You have car insurance, right? But you don’t use that car insurance at the pump, or for oil changes, do you? Of course not, because that wouldn’t make sense. You pay the mechanic or gas station directly for those day to day things, and save the insurance for more emergency-type situations such as accidents, or major repairs.

You wouldn’t dream of filing a claim each time your gas light comes on, so why would you file a claim for a flu shot?

Such is the case with health insurance

The Direct Care business model supports patients in maintaining a high-deductible wrap-around plan in case of emergencies such as hospitalizations, surgeries, or other life-threatening situations. But for routine cases like physicals, labs, or most other minor emergency situations, the Direct Care subscription fee covers nearly everything and can be handled in-house most of the time.

Does everyone benefit?

Many Direct Care clinics work directly with insurance companies who, in turn, work directly with patients to find the perfect wrap-around plan for their families. When your patients and companies are paying for what they need only when they need it, the savings are passed all the way around the table. Even insurance companies see the benefits of having more legitimate claims filed by those who are more prepared to handle emergency situations.

So do you have to ditch insurance?

The short answer is no. If you choose, you may still accept insurance. It might make things trickier for you, as you don’t have an insurance department at the ready to handle claims, glitches, and updates. So that means more of your time will be spent handling those things

Swap insurance for Direct Care

The Direct Primary Care Journal reported on a trend we’re thrilled to see – the furthering spread of Direct Care.

Rather than join the trend of independent doctors securing their financial future through mergers with large health systems, many are adopting a new business model that eliminates the need for third-party reimbursements: direct primary care.

The DPC Journal explains many of the reasons more and more docs are considering the transition from the traditional primary healthcare model: no more hassling with insurance, no more ridiculous regulations to adhere to, no pressure to shuffle patients in and out of the office at an alarming rate just to turn a profit… to name a few.

Those reasons are all well and good – but they are added benefits to being able to truly put patients first. After all, that’s what we went to medical school for in the first place, right? If you operate under the premise that patients are your priority, the rest just falls into place.

READ THE FULL ARTICLE ONLINE >

The article also mentions “…many direct-pay practices are lacking a digital tool to help them capture data and monitor their patient population’s health.” We know! That’s why we’ve worked so hard to develop an EMR made for Direct Care docs, by Direct Care docs. It’s a great tool custom created for the Direct Care practice; by catering to the Direct Care model, it integrates perfectly with all the special features Direct Care has to offer, like integrating patient communication (whether it be by email, text, or phone) directly into the patient’s chart. Its smart features allow you to … wait for it… focus on patients rather than hassle with paperwork.

What's next?

Now that you know the ins and outs of insurance and how it correlates with Direct Care, let’s talk about some other aspects of how you’ll make money with your clinic. In the next section we dive into charging and billing for Direct Care services. We’ll look at what features you can offer, and what you might consider charging for them. So let’s take this education to the next level!

Next